- Home

- Views On News

- Jun 15, 2023 - Veteran Fund Manager Picks Stake in Smallcap Textile Company. Stock Zooms 20%

Veteran Fund Manager Picks Stake in Smallcap Textile Company. Stock Zooms 20%

Among the bulk deals that took place in yesterday's trading session, the one by Madhusudan Kela caught the attention of investors.

Data from the exchanges shows that ace investor Madhuri Kela, wife of Madhusudan Kela, picked up a stake in a smallcap textile firm.

Shares of the company rallied over 17% yesterday to touch a new 52-week high. Today, the stock is up 2%.

Before we move to the stock details, let's take a look at who Madhusudan Kela is and his top stock picks.

Who is Madhusudan Kela?

Known for his ability to identify quality companies with strong growth prospects, Madhusudan Kela is one of the most well-known and seasoned investors in the Indian stock market, with an extensive experience of over 27 years.

He prefers a value investing style and has a long-term investment horizon.

Which textile stock did Madhusudan Kela buy and why?

According to data from exchanges, Madhuri Kela bought 8.4 lakh shares or 1.67% stake in Sangam (India) at a weighted average price of Rs 268 per share.

Sangam (India) manufactures and exports textiles. The company is the largest producer of PV dyed yarn in Asia at a single location.

It's also a forerunner in manufacturing ready to stitch fabric. It's annual capacity is 30 million (m) meters of fabric and 48 m meters of denim.

The veteran fund manager initially took a stake in the textile firm in the September 2022 quarter. Back then, he had acquired a 1.1% stake.

While we don't know the exact reasons why he doubled down on Sangam (India), there are some reasons we can guess...

The first reason being capex theme playing out. Sangam India had earlier guided for a capex of around Rs 3 bn in FY23. However, during the same period gone by, it incurred a capex of Rs 5.2 bn to increase capacity in a phased manner.

Once the effect of enhanced capacities comes into play, Sangam India could see costs come down and maximum optimisation. Some of its plants where capacity expansion is underway will be operational by October 2023 and some by January 2024.

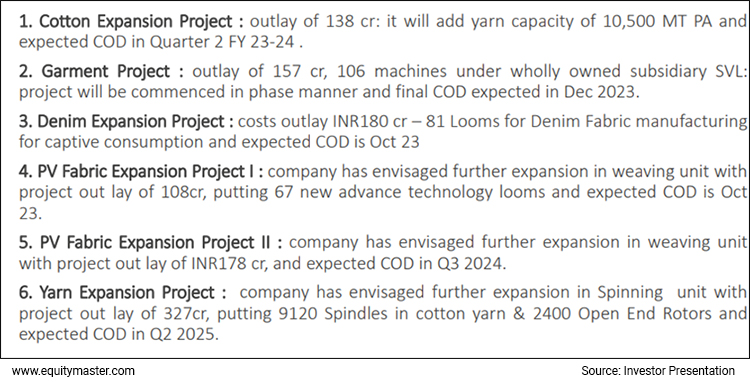

Sangam (India) in an Expansion Mode

The second reason behind Madhusudan Kela's bullishness could be the strong operational performance it has shown in the past three years.

Sangam India is also a beneficiary of China plus one megatrend.

Sangam India Financial Snapshot

| Rs m, consolidated | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|

| Revenue | 18,735 | 17,901 | 13,590 | 24,378 | 27,150 |

| Growth | 14% | -4% | -24% | 79% | 11% |

| Operating profit | 1,682 | 1,700 | 1,320 | 3,145 | 3,020 |

| OPM (%) | 9% | 9% | 10% | 13% | 11% |

| Net profit | 132 | 133 | 42 | 1,407 | 1,350 |

| NPM (%) | 1% | 1% | 0% | 6% | 5% |

| Debt to Equity | 1.4 | 1.2 | 1.1 | 1.1 | 0.9 |

One more reason could be the turnaround in the textile sector, which has been due for a long time. With input cotton prices on a decline, the textile sector is set for a strong comeback in 2023.

All being said, the export segment needs to be tracked closely as it saw a 28% dip in exports due to weak demand. The same could continue for some quarters owing to macro-headwinds in the European and US markets.

How Sangam India shares have performed recently

In the past five days, Sangam India share price has rallied over 20%.

Yesterday, shares of the company rallied 20% in intraday trade before settling 17% higher at Rs 333 per share.

In the past one year, Sangam India shares have rallied 23% while on a year-to-date basis, shares are up around 41%.

Sangam India touched a 52-week high of Rs 360 yesterday and a 52-week low of Rs 185 on 20 January 2023.

Have a look at the table below which compares Sangam India with its peers.

Comparative Analysis

| Company | Fiberweb India | Himatsingka | Indo Count | Pearl Global | Sangam |

|---|---|---|---|---|---|

| ROE (%) | 6.9 | 10.1 | 25.0 | 21.2 | 15.2 |

| ROCE (%) | 8.4 | 9.7 | 22.5 | 29.7 | 17.8 |

| Latest EPS (Rs) | 2.2 | -6.5 | 14.0 | 68.9 | 26.0 |

| TTM PE (x) | 14.5 | 0.0 | 14.7 | 8.1 | 12.8 |

| TTM Price to book (x) | 0.5 | 0.8 | 2.3 | 1.7 | 1.8 |

| Dividend yield (%) | 0.0 | 0.4 | 1.0 | 0.9 | 0.6 |

| Industry PE | 48.4 | ||||

| Industry PB | 6.1 | ||||

About the company

Sangam (India) is engaged in the business of manufacturing and selling of synthetic blended, cotton & texturised yarn, fabrics, denim fabrics and readymade seamless garment.

It operates various brands such as Sangam Yarns, Sangam Suitings which is also the flagship brand, Sangam Denims and C9 Airwear.

It has clients including Banswara Syntex, Siyaram, RSWM Limited, Arvind, Trident, Marks & Spencer, Reliance Trends, Zivame, Myntra, Lifestyle International, Benetton and Westside, among others.

To know more, check out Sangam India's financial factsheet and its latest quarterly results.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

FAQs

Which are the top smallcap companies in India right now?

As per Equitymaster's Indian Stock Screener, these are the top smallcap companies in India right now.

- #1 CARBORUNDUM UNIVERSAL

- #2 CRISIL

- #3 NLC INDIA

- #4 WABCO INDIA

- #5 TIMKEN INDIA

These smallcap companies have been ranked as per their market capitalization. The higher the market cap, the higher the total value of the company.

Of course, there are other parameters you should take into account before forming a hard opinion on the stock valuation.

What are smallcap stocks?

According to the market regulator, smallcap stocks are companies which rank 251st and beyond in terms of their market capitalisation.

What are the benefits of investing in smallcap stocks?

Smallcap growth stocks are one of the most exciting segments in the market, as small companies with higher growth rates often offer investors the opportunity for market-beating returns.

These companies are sitting on the runway, waiting to take-off. However, they usually tend to trade at a premium valuation.

If you're looking to invest in smallcap stocks, read our detailed guide to screen the best smallcap stocks.

Equitymaster requests your view! Post a comment on "Veteran Fund Manager Picks Stake in Smallcap Textile Company. Stock Zooms 20%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!